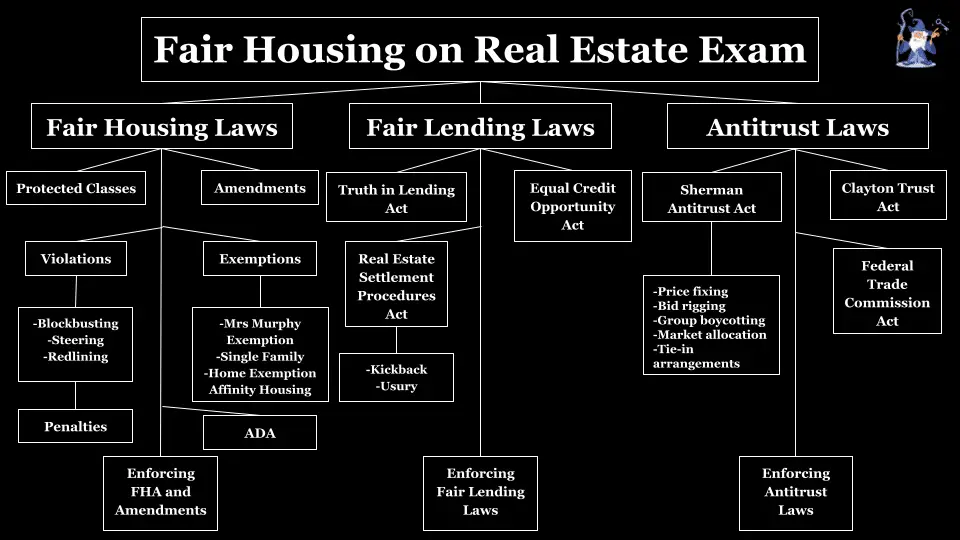

The topic of fair housing is massive as it covers a wide variety of topics. Luckily In this guide we will go over every single essential you need to know for the real estate exam. We will go over fair housing law, fair lending law, antitrust law, all of the important amendments, exemptions, protected classes, violations, and more.

Fair Housing Laws

Fair housing is an essential topic on the real estate exam because it is fundamental to real estate practice. Real estate professionals, including agents, brokers, and property managers, must adhere to fair housing laws and regulations to ensure that they do not engage in discriminatory practices in their work. Therefore, understanding fair housing laws and their application is critical for passing the real estate exam and practicing real estate ethically and professionally.

Moreover, fair housing laws are an essential component of the real estate industry, and real estate professionals must be knowledgeable about these laws to avoid violating them. Violating fair housing laws can lead to severe consequences, including legal action, license revocation, and damage to one’s professional reputation. Thus, the real estate exam includes fair housing questions to test a candidate’s understanding of these laws and their significance in real estate practice.

To understand fair housing, we have to understand where it all began. And that is with the Civil Rights Act of 1866.

What is the Civil Rights Act of 1866?

The Civil Rights Act of 1866 declared that all persons born in the United States are created equal by the law. This civil rights bill protected the rights of freed slaves, ensuring they had the full and equal benefits of the same laws as white people. African Americans could no longer face discrimination because of their race, color, or previous slavery or involuntary servitude.

But to which personal freedoms did black citizens finally have access? Well, most notably, the Civil Rights Act of 1866 said that recently enslaved people had the right to

- Make and enforce contracts

- Sue and be sued

- Give evidence in court

- Purchase, lease, sell, hold, and convey real and personal property

Among the many benefits of the 1866 Civil Rights Act, one of the most important was that any person born in the United States could own property regardless of color or race. This new law greatly impacted the real estate world, opening the door for conversations about fair housing and housing discrimination.

Unfortunately, the passage of this civil rights bill did not immediately ensure peace and equality for all. Sure, black citizens could finally own property in the United States, but racial discrimination and segregation were still rampant.

To make matters worse, black citizens were also fighting against voter suppression. Their ability to vote for more stringent fair housing laws was compromised, as they were intimidated at polling places and turned away. Considering all of this, it is safe to say that African Americans received only nominal freedom due to the 1886 act.

It is also important to note that this act was primarily focused on ending discrimination against formerly enslaved people. In terms of housing, there were still other groups being discriminated against, including women and minorities with different religions.

The Civil Rights Act of 1866 was groundbreaking for its time, but it was clear that there was still a long way to go.

Nearly a century after the first, President Johnson signed the Civil Rights Act of 1964 into law. Like the Civil Rights Act of 1866, this bill ensured protection for people of all races and colors but added a few other categories into the mix. Creating something called a protected class.

What Is the Civil Rights Act of 1964?

The Civil Rights Act of 1964 prohibited discrimination against the following protected classes:

- Race

- Color

- National origin

- Religion

- Sex

This was a good start for discrimination, but some improvements were still needed and that’s when the Civil Rights Act was created. The Civil Rights Act of 1968 expanded on previous acts and notably prohibited discrimination concerning the sale, rental, and financing of housing. This was introduced by Title VIII of the Act, also known as the Fair Housing Act (of 1968).

What Is the Fair Housing Act of 1968?

The Fair Housing Act of 1968 (FHA) protects buyers and renters from discrimination when looking for housing.

When the Fair Housing Act was first enacted, it included the following protected classes:

- Race

- Color

- National origin

- Religion

Since 1968, more protected classes have been added to the list, and a few have had their definition expanded upon.

Today there are seven protected classes which include the following:

- Race

- Color

- National origin

- Religion

- Sex (including sexual orientation and gender identity)

- Familial status

- Disability

It’s essential to know when these highlighted classes were added and why. Sex was added by the Housing and Community Development Act of 1974.

What Is the Housing and Community Development Act of 1974?

The Housing and Community Development Act (HCD) amends the Fair Housing Act by adding sex as a protected characteristic and providing funding to low-income families. Before 1974, housing providers could legally discriminate against and deny housing to women.

Since 1974, the definition of sex has expanded to include sexual orientation and gender identity. This means that same-sex couples and transgender individuals are now protected under the Fair Housing Act.

But what about familial status and disability? Well, it took 14 years to get those added to the list. They did this by amending the fair housing act, creating the Fair Housing Amendments Act of 1988.

What Is the Fair Housing Amendments Act of 1988?

The Fair Housing Amendments Act of 1988 strengthens the original Fair Housing Act and extends its protection to two additional groups. Thanks to this amendment, the federal government has more power to enforce anti discriminatory laws and combat discriminatory housing practices.

This act also gives more homebuyers and renters power than the first FHA, as its safety net covers families with children and individuals with disabilities. To this day, real estate professionals and landlords are required to abide by the Fair Housing Amendment Act of 1988. And that gives us our seven protected classes.

Now it’s worth mentioning states and cities have their own housing laws, many of which are not backed by the Fair Housing Act.

Examples of other protected characteristics include:

- Age

- Citizenship status

- Lawful occupation

- Lawful source of income

- Marital status

- Partnership status

- Status as a veteran or military service member

- Status as a domestic violence or stalking victim

If any of these protected classes are facing housing discrimination, the federal Fair Housing Act does not cover them. But your state specific fair housing law may. So it’s essential as a real estate agent to fully understand your specific state’s fair housing law.

Why Is Fair Housing Important?

Fair housing is important for several reasons.

First, it promotes equal opportunity and helps to eliminate discrimination in housing, which is a basic human right. Second, it helps to create diverse and inclusive communities, which can lead to greater social cohesion and stronger neighborhoods. Third, it benefits the real estate industry by promoting professionalism and ethical behavior among real estate agents, landlords, and lenders. Finally, fair housing laws help to ensure that people are able to access safe and affordable housing, which is essential for maintaining stable households and promoting economic mobility.

So now that we covered the Fair Housing Act, its amendments, and protected classes.

What Types of Housing Does the FHA Cover?

The Fair Housing Act protects most housing types for home seekers with protected characteristics. Examples include:

- Single-family homes

- Multi family homes

- Apartments

- Condos

- Mobile homes

- Nursing homes

Essentially, if a property constitutes a dwelling or place of residence, there’s a strong chance that interested buyers and renters are protected under the FHA.

Who Does the Fair Housing Act Not Protect?

While the Fair Housing Act and its amendments cover a lot of ground, it’s important to note that this act doesn’t cover all housing types.

Examples of housing not covered under the FHA include:

- Apartment buildings with less than five units

- Single-family housing sold without a real estate agent

- Housing for religious organizations

- Hotels and motels

- Private clubs

Examples of Fair Housing Act Violations

Real estate professionals must understand which behaviors violate the Fair Housing Act and contribute to housing discrimination.

That’s why we’ve compiled a list of examples of FHA violations, some of which include:

- Refusing to show minorities houses in certain neighborhoods

- Charging renters with children additional fees

- Refusing to repair a tenant’s unit because of their sexuality

- Suggesting that minorities live in an area with other minorities

- Harassing a homebuyer because of their religious beliefs

Now within these violations there’s a few specific ones we need to cover for the exam. Blockbusting, Steering, and Redlining.

Redlining

Redlining is the denial of goods or services to people of a protected class. Redlining in real estate commonly involves lending, which is where its origin began. During the 1920s, banks would literally draw red lines on maps, defining “safe” areas to invest or grant loans, and the majority of those red areas were in minority neighborhoods.

It’s worth mentioning redlining for the real estate exam will likely refer to discrimination in the lending industry by not granting loans to people of a protected class.

Steering

Steering is the illegal practice of guiding, or steering, someone to purchase or rent a home in a specific area or community based on their race, religion, gender, color, familial status, or disability.

Steering is a form of redlining in that you deny a service to someone based on their race, religion, family status, etc.

Blockbusting

Blockbusting is another form of discrimination, but slightly different than steering and redlining.

Blockbusting involves convincing sellers that the socioeconomics of an area is changing in an unfavorable direction, therefore enticing them into selling their homes. It can be as obvious as telling people that minorities are moving into their neighborhoods, and if they don’t sell now, their property values will decrease.

Understanding those violations is essential also, remember that these practices were made illegal by the Fair Housing Act so that’s their relation to all of this. Now lets cover Penalties for Violating the Fair Housing Act.

Penalties for Violating the Fair Housing Act

Why should a future real estate professional such as yourself avoid violating the FHA? According to the Department of Housing and Urban Development, penalties for violating the FHA include:

- $16,000 for a first-time violation

- $37,500 if a previous violation has occurred in the last 5 years

- $65,000 if two previous violations have occurred in the last 7 years

In cases where home providers use force or the threat of force to violate fair housing laws, the penalties are more serious, including possible time in prison.

FHA Enforcement

The FHA is enforced by the U.S. Department of Housing and Urban Development (HUD), which investigates complaints of housing discrimination and takes legal action against violators. HUD also provides education and outreach programs to promote fair housing awareness and compliance among housing providers and consumers. Additionally, HUD funds state and local agencies that enforce fair housing laws that are substantially equivalent to the FHA.

Now we must discuss Fair Housing Act exemptions.

Fair Housing Act Exemptions

The Fair Housing Act has certain exemptions where housing providers can discriminate.

The three exceptions to the Fair Housing Act are:

- Mrs. Murphy Exemption

- Single-Family Home Exemption

- Affinity housing

What Is the Mrs. Murphy Exemption?

The Mrs. Murphy Exemption states that if an owner-occupied dwelling has four or fewer rental units, it is exempt from the Fair Housing Act. This means that if a property owner lives in a home with three other rented rooms, they can technically discriminate against certain protected classes.

The Mrs. Murphy Exemption works differently now than it did in 1964. For example, the Mrs. Murphy’s of the world can no longer discriminate based on race; the Civil Rights act of 1866 strictly forbids it.

However, property owners who fall under the exemption can still discriminate based on:

- Sex

- Religion

- Familial status

- Disabilities

If Mrs. Murphy prefers renting to female tenants or fellow widows to support her limited income, this exemption gives her the right to turn down other applicants.

If you think this exemption sounds problematic, you’re not alone; many fair housing groups have called for its repeal. These organizations argue that the Mrs. Murphy Exemption encourages housing discrimination by denying equal opportunities to protected classes.

Some states even have systems that limit or completely override this discriminatory loophole.

What Is the Single-Family Home Exemption?

The Single-Family Home Exemption states that any single-family dwelling sold without an agent is exempt from the FHA. This means single-family homeowners can be more discriminatory when selling their homes themselves.

What Is a Single-Family Home?

A single-family home is a residential property not attached to any other units. These homes are for only one family to live in at a time.

Examples of non-single family homes include:

- Apartments

- Townhouses

- Condos

- Duplexes

- Mobile homes

The single-family exemption does not cover multi-family homes and other property types. Homeowners selling multi-family properties must follow all fair housing laws.

When Does the Single-Family Home Exemption Apply?

As mentioned, there are a few conditions to the Single-Family Home Exemption Act. For example, this exemption only applies when:

- The homeowner is not using a licensed real estate agent or broker

- The homeowner owns fewer than three other single-family homes

- The homeowner is not living on the property during the sale

- No discriminatory advertising is used for the sale

- The exemption has not been used in the previous 24 months

The sale or rental of the home must meet all of these conditions for it to be exempt from fair housing laws.

When Does the Single-Family Home Exemption Not Apply?

This exemption still does not allow homeowners to discriminate based on race. They can only discriminate against characteristics such as sex, religion, or familial status.

In fact, there is no exemption to the federal Fair Housing Act that allows housing providers to discriminate racially. This is all thanks to the Civil Rights Act of 1866. This act asserts that citizens must be treated equally regardless of race.

Affinity Housing

Affinity housing is another exemption to the Fair Housing Act. This type of housing allows protected classes to live in exclusive communities. The purpose of these communities is to create a safe space where tenants with shared cultures can live together.

Examples of affinity housing include:

- Black affinity communities on college campuses

- Same-sex dormitories on college campuses

- Senior housing communities

- Housing for religious organizations

- Private clubs offering housing as amenities

Affinity housing is not housing discrimination because it is purely optional. Protected classes do not have to live in affinity communities. If they did, that would be housing segregation. Affinity communities only exist to give marginalized groups the option to live among like-minded tenants.

Now there’s one other fair housing law I wanted to cover before we move into fair lending. It’s not a part of the fair housing act but is super important to know.

What Is the Americans with Disabilities Act of 1990?

The Americans with Disabilities Act (ADA) protects people with disabilities against discrimination in housing. This federal law states that housing providers must provide equal opportunities for persons with physical or mental impairments.

The Americans with Disabilities Act of 1990 plays a significant role in real estate. Under this act, housing providers must make reasonable accommodations and modifications to ensure disabled people can live comfortably in their units. If such accommodations are not made, housing providers can face legal repercussions.

What Types of Property Are Covered by the ADA?

The Americans with Disabilities Act of 1990 covers most housing types, including:

- Private housing

- State or local government housing

- Public housing

- Federally assisted housing programs

This means that apartment buildings, hotels, motels, inns, and other housing units must comply with the ADA.

What Types of Property Are Not Covered by the ADA?

The Americans with Disabilities Act of 1990 does not cover the following properties:

- Residential properties

- Religious organizations

- Private clubs

This means that privately owned homes, churches, and clubs do not have to comply with the ADA.

The ADA was expanded in 2008.

What Is the ADA Amendments Act of 2008?

The ADA Amendments Act of 2008 empowered the ADA to protect more people with disabilities. Before this amendment, the Supreme Court had interpreted the definition of “disability” very narrowly. This meant that individuals with certain disabilities were not winning their cases against housing discrimination.

The ADA Amendments Act expanded the definition of “disability” so that more people with physical or mental impairments were protected under the law.

Fair Lending Laws

Now that we’ve covered the specific Fair Housing act and everything that is accompanied with it we have to talk about fair lending which is a significant chunk of fair housing.

What Is the Truth in Lending Act?

The Truth in Lending Act (TILA) protects consumers against unfair and predatory lending practices from credit companies. This act, passed in 1968, requires that lenders fully explain to consumers the terms and conditions of their loans.

The Truth in Lending Act prohibits unfair credit practices that are designed to put more money in mortgage brokers’ pockets. This act protects consumers who are taking out home mortgage loans and home equity lines of credit.

The Truth in Lending Act ensures that lenders provide consumers with a Closing Disclosure explaining all the mortgage loan details. These details include:

- Loan terms

- Purchase price

- Monthly payment amount

- Closing costs

- Other fees

Penalties for Violating the Truth in Lending Act

If a creditor violates the Truth in Lending Act for any reason, they may be fined $5,000, face one year of imprisonment, or both in severe cases.

Now there were a few amendments to the truth in lending act throughout the years.

What Is the Fair Credit Billing Act?

While the Truth in Lending Act plays a significant role in the real estate world, the Fair Credit Billing Act (FCBA) takes it a step further. Enacted in 1974, the FCBA amends the TILA by ensuring creditors cannot negatively impact an individual’s credit before an investigation is done.

The Fair Credit Billing Act allows consumers to dispute credit billing errors, including:

- Unauthorized charges

- Finance charges with incorrect amounts

- Finance charges with incorrect dates

- Charges for items or services that were not delivered

- Questionable charges

Furthermore, the FCBA demands a fair and timely resolution for credit billing disputes so that the offending lenders right their wrongs as soon as possible.

As long as borrowers dispute credit billing errors within 60 days from the time they receive their bill, the FCBA has their back and will protect their credit.

What Is the Dodd-Frank Truth in Lending Act?

There’s another notable act we should know about that amended the TILA, and that’s the Dodd-Frank Truth in Lending Act. The Dodd-Frank TILA, enacted in 2010, requires the following extra protections from lending companies:

- Mortgage loan officers need a license to offer credit loans

- Lenders must adjust the dollar threshold for exempt consumer credit annually

- Lenders must make reasonable determinations of a consumer’s ability to pay back the credit for a home

The last amendment listed is among the most important, as it means creditors cannot give out loans to borrowers who likely cannot repay them. We know that credit checks are now required to determine a borrower’s ability to repay, but this was not always the case before acts like the Dodd-Frank TILA were enacted.

Now we covered the truth in lending act and its amendments we let’s talk about another essential fair lending act.

What Is the Equal Credit Opportunity Act?

The Equal Credit Opportunity Act (ECOA) prohibits discrimination against borrowers applying for home loans. Per the ECOA, lending institutions cannot treat protected classes differently than anyone else.

Who Are the Protected Classes Under the ECOA?

The ECOA prohibits discrimination against the following protected characteristics:

- Race

- Color

- Religion

- National origin

- Sex (including gender identity and sexual orientation)

- Age

- Receipt of income from a public assistance program

- The applicant’s exercise of any right under the Credit Consumer Protection Act

What Is the Consumer Credit Protection Act?

The Consumer Credit Protection Act (CCPA) protects consumers from abusive lending practices. This act encompasses the Equal Credit Opportunity Act or Title VII.

What Housing Loans Does the ECOA Cover?

Under the Consumer Credit Protection Act, the ECOA covers:

- Mortgage loans

- Home improvement loans

- Home equity loans

The History Behind the Equal Credit Opportunity Act

Let’s talk about why the Equal Credit Opportunity Act was passed in the first place.

Women were regularly facing discrimination from mortgage lenders before the ECOA. These lenders often refused to consider a married woman’s income when giving out loans. They also denied credit loans to single women more often than other applicants.

The Equal Credit Opportunity Act was created to prohibit this type of discrimination based on sex and marital status. However, it wasn’t very long after that Congress amended the act to include the other protected classes listed above.

Penalties for Violating the ECOA

Lending institutions who violate the ECOA can be sued in court for:

- actual damages

- punitive damages of up to $10,000 for individual lawsuits

- $500,000 or 1% of their net worth for class-action lawsuits

Another essential fair lending act you need to understand for the real estate exam is the Real Estate Settlement Procedures Act.

What Is the Real Estate Settlement Procedures Act?

The Real Estate Settlement Procedures Act requires that lenders and mortgage brokers provide homebuyers with disclosures regarding the real estate settlement process. This act, also known as Regulation X, protects homebuyers from predatory lending agreements.

What Do Real Estate Settlement Services Do?

Before we can understand how RESPA works, we must understand what a settlement service is. A real estate settlement service helps homebuyers with the closing process after purchasing a home. These organizations generally provide title insurance or offer escrow services.

Before RESPA, there were few laws regulating these types of services. This meant that lenders could get away with abusive behaviors, including doling out predatory loan terms. That’s why RESPA was passed in 1974 to protect borrowers from these practices and support a fair housing market.

How Does RESPA Protect Homebuyers?

RESPA protects homebuyers from unjust practices and surprise fees in mortgage loans. Under RESPA, lenders have to be upfront about the costs of their real estate settlement services. They must disclose a good faith estimate of how much the borrower will pay. This allows consumers to make informed decisions and shop for the best deal.

RESPA also prohibits mortgage companies from adding kickbacks and referral fees to the cost of a real estate settlement. This saves homebuyers money by ensuring they only have to pay for the cost of the actual work done.

Finally, RESPA allows homebuyers to seek help if a mortgage company overcharges or takes advantage of them. If a lender includes hidden fees in a home loan, homebuyers are protected under federal law and will not have to pay these charges.

What Loans Does RESPA Cover?

The Real Estate Settlement Procedures Act covers all federally related mortgage loans for one-to-four-family properties. A federally related mortgage loan is a loan for a residential property insured by the government. This includes:

- Home loans

- Home improvement loans

- Refinances

- Equity lines of credit

- Reverse mortgages

- Lender approved assumptions

What Loans Does RESPA Not Cover?

RESPA does not apply to commercial or business loans. If a property is not a dwelling intended for families to live in, buyers are not protected by this federal law. Examples of loans that RESPA does not apply to include:

- Extensions of credit to the government

- Loans for businesses

- Loans for commercial purposes

- Loans for agricultural purposes

What Does RESPA Prohibit?

RESPA prohibits predatory lending tactics that force homebuyers to pay more for settlement services. Examples of RESPA violations include:

- Offering kickbacks and referral fees

- Requiring large escrow account balances

- Inflating costs of services (usury)

- Bribing in exchange for referrals

- Not disclosing good faith estimated settlement costs

- Demanding title insurance

We must highlight two violations on this list – kickbacks and usury.

What Is a Kickback?

A kickback is when a real estate agent receives financial benefits or items of value for referring clients to a business or service. This practice is called a kickback because it kicks some of the profit gained from referrals back to the agent who helped them get it.

Kickbacks are illegal because real estate agents are responsible for being transparent with their clients. When an agent only refers a business to homebuyers because they are incentivized to, it’s a conflict of interest. Real estate agents should make referrals based on the best option for homebuyers – not themselves.

What Is Usury?

Usury is the act of lending money at unreasonably high-interest rates.

Usury laws protect homebuyers from taking out home loans with exorbitant interest rates. States each have their own usury laws that set a maximum interest rate limit for lenders to follow.

These laws prohibit predatory lending practices and ensure that homebuyers pay interest at reasonable rates. State usury laws vary, so real estate professionals need to be familiar with the maximum interest rate for their state.

Who Enforces Fair Lending Laws like the Truth in Lending Act, the ECOA, and RESPA?

Three different agencies enforce fair lending laws and safeguard consumers from corrupt creditors. These agencies are:

- The Federal Trade Commission

- The Consumer Protection Financial Bureau

- The Office of the Comptroller of the Currency

Antitrust Laws

Now that we covered fair housing, and fair lending, we need to cover antitrust laws. Like fair lending, antitrust laws encompass fair housing.

What Is the Sherman Antitrust Act?

The Sherman Antitrust Act is the first federal law prohibiting contracts, conspiracies, or agreements that restrain trade.

Antitrust laws are a collection of federal and state government laws that regulate the conduct and organization of business corporations. These laws typically aim to promote fair competition for the benefit of consumers.

The three major antitrust laws are:

- The Sherman Antitrust Act

- The Clayton Act

- The Federal Trade Commission Act

Sherman Antitrust Act Prohibited Behaviors

The Sherman Act prohibits several behaviors that compromise a fair housing market, including:

- Price fixing

- Bid rigging

- Group boycotting

- Market allocation

- Tie-in arrangements

These are all examples of antitrust violations in real estate, but what do they each mean? Let’s take a closer look!

Price Fixing

Price fixing is the practice of setting the price of a good or service to make a particular price a standard. Any agreement, even if it just implied with other brokerages to set a standard commission rate, violates antitrust law.

One example of price fixing would be two brokers getting together and agreeing to offer their clients the same price or commission rate. This interferes with a fair market and means that clients will have to pay higher prices.

Bid Rigging

Bid rigging is an illegal practice where competitors agree in advance on who will win the bid on a property. This creates higher pricing than what would have occurred under a free market, effectively cheating consumers into paying more.

For example, if two competing realtors agree to take turns being the lowest bidder to drive up the price of a home sale, this is considered bid rigging.

Group Boycotting

Group boycotting is when two or more people conspire against another business by no longer supporting or working with it.

For example, if two brokers agreed never to conduct business with a third broker to have less competition, then it’s a clear violation of the Sherman Antitrust Act.

Market Allocation

Market allocation is when real estate brokers divide the market amongst themselves so they don’t have to compete with each other. This behavior is considered engaging in monopolistic practices and violates antitrust law.

One example of market allocation is if brokers decided to split up their area into different regions, designating a different realtor for each spot. This means that within each region, there is no competition, and home buyers will end up having to pay more.

Tie-in Arrangements

A tie-in arrangement is when a seller requires the purchase of another separate product/service for the sale of the first.

An example of a tie-in arrangement would be if a real estate agent agreed to sell a property only if the buyer agrees to list the property with their firm.

Penalties for Violating the Sherman Antitrust Act

The penalties for breaking antitrust laws include hefty fines and even jail time in some cases.

Many people didn’t pursue legal action against offenders, as the cost and time that went into a court case were deemed not worth it.

Why wasn’t it worth the trouble? Well, the Supreme Court severely limited the power of the Sherman Antitrust Act, nearly making these antitrust laws obsolete. Many consumers didn’t feel they could win antitrust cases against big businesses.

New acts have since been created to uphold antitrust legislation and ensure fair business competition. This brings us to the new and improved version of the Sherman Act, the Clayton Act.

What Is the Clayton Trust Act?

Like the Sherman Antitrust Act, the Clayton Act of 1914 was designed to break up monopolies and ensure fair competition in the market. So what does this antitrust law offer that the Sherman Act didn’t?

The Clayton Act strengthened the original antitrust law, explicitly listing business practices that would compromise a fair market. No longer could businesses find loopholes around the Sherman Act; these new antitrust laws were clear and final. In fact, we still operate under these laws today.

What Is the Federal Trade Commission Act?

The Federal Trade Commission Act (FTC) of 1914 enforces the Clayton Act and ensures fair practice in all markets, including housing. Any real estate business must ensure they are meeting the legal standards of the FTC by not breaking antitrust laws.

The FTC Act also declared that strikes, boycotts, and labor unions would be legal under federal antitrust laws.

This gives consumers even more power, as big businesses can’t take advantage of them without the threat of repercussions. If a company were unethical in some way, consumers could stop buying its goods and support the competition instead. If a business wasn’t treating its employees well, it could organize within its labor union and go on strike.

Essentially, acts like the Clayton Act and the Federal Trade Commission Act are the new and improved versions of the Sherman Antitrust Act.