You guys asked; we heard you and answered. Today, we are covering drum roll, please, real estate math.

But instead of just covering math questions, we pulled the ultimate trick out of our hat: one formula to help you through that exam.

What is it? How does it work? Is it even real? Let’s get to it.

What Is the Formula?

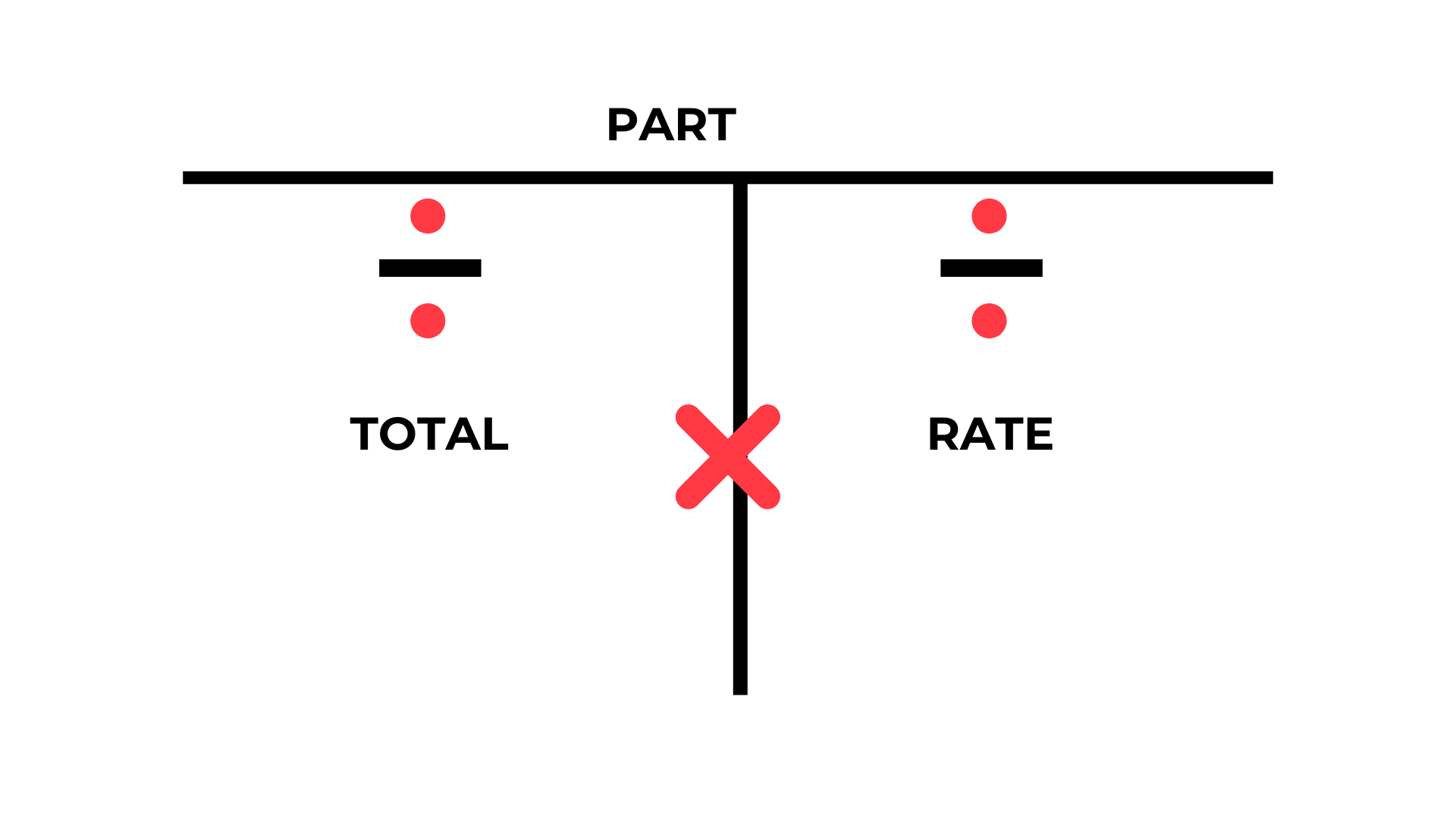

In some corners, it’s called the T-Chart formula, while others simply refer to it as the T-Formula. Whatever name you choose, the T-Chart is a math concept that will revolutionize the way you approach real estate math.

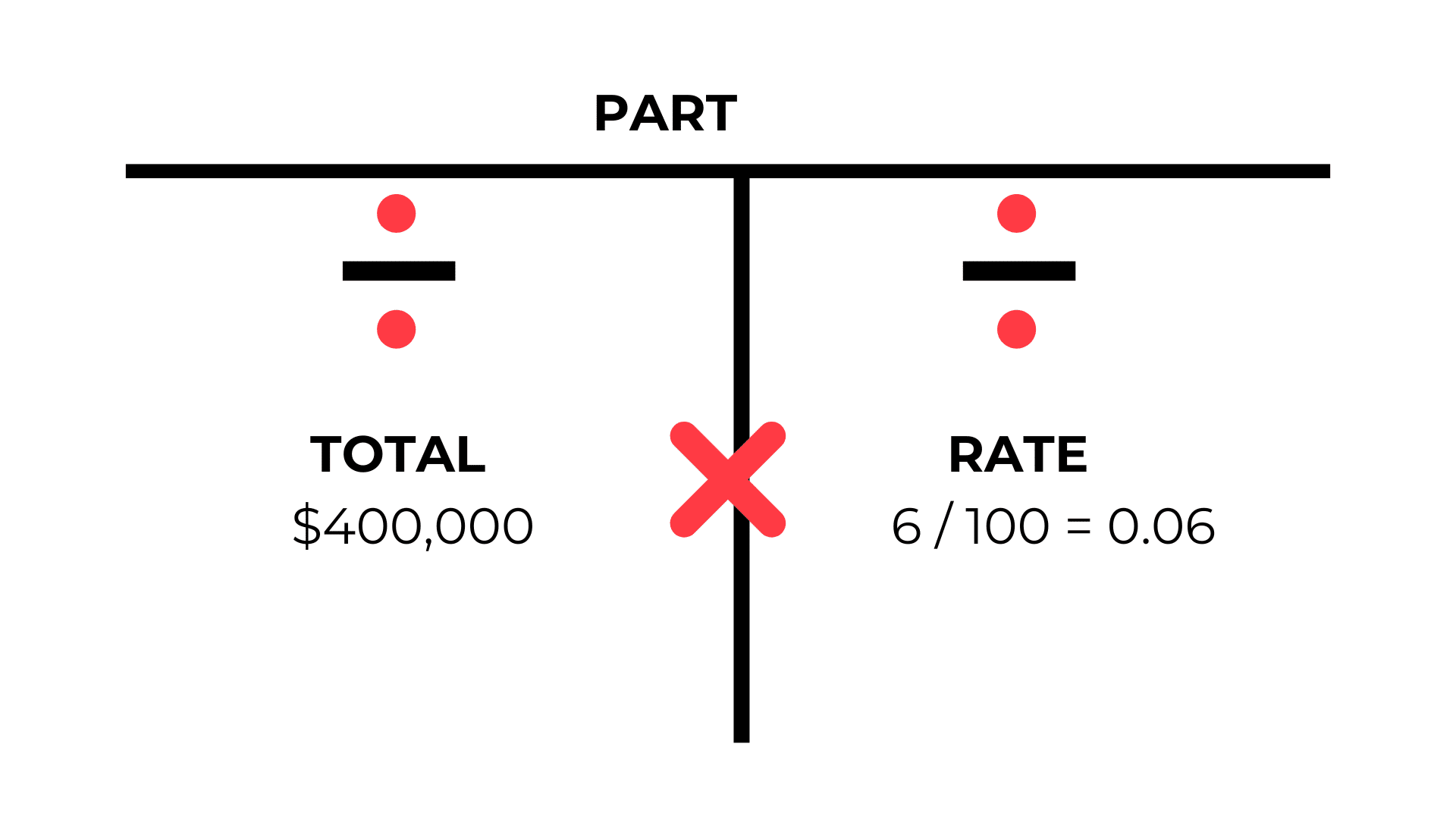

It is called the T-Chart because it is shaped like a T. This allows it to have room for three variables. Let me explain:

Most of the math questions you will encounter on your exam will have three parts: two known and one unknown. You will solve for the unknown part.

For example:

A real estate agent closes on a house valued at $400,000. The listing agreement states that the seller will pay 6% to both the listing agent and the buyer’s agent. What total does the seller pay?

- $24,000

- $50,000

- $12,000

- $7,500

We have $400,000, which is the total price of the house, and a commission rate of 6%. These two variables are known. Then, we have one unknown variable, which is the total amount paid out by the seller.

We will talk about the answer later on in the video.

Just like the number of variables, the chart has three math operations.

What are mathematical operations? The very things you learned in elementary: Addition, subtraction, multiplication, and division.

On the T-Chart, we use two division signs and one multiplication sign.

If you have a rate and a part, you will have to divide to get to the total. The same applies when you have a total and a part calculating the rate. But if you have a total and a rate, calculating a part, you will multiply.

How Does It Work?

The T-Chart uses the simple method of substitution. You know how in football there are those players waiting on the side called substitutes, waiting to jump in should anything happen to the players on the field?

Yep, that method. The numbers in your question will replace the variables on the chart.

Let’s go back to our commission example above.

We have a total house price of $400,000 and a commission rate of 6%. So, we are going to substitute these values into the T-Chart, basically replacing the elements on the chart with these values.

Remember to always divide the 6 by 100 since we are working with a percentage. Then calculate: 400,000 * 0.06 = $24,000.

So, the final answer is $24,000 because we are calculating the total amount the seller has to pay, not the individual amounts each agent/broker takes home.

Five Practice Questions

Let’s try a few questions to test out this formula:

Question 1

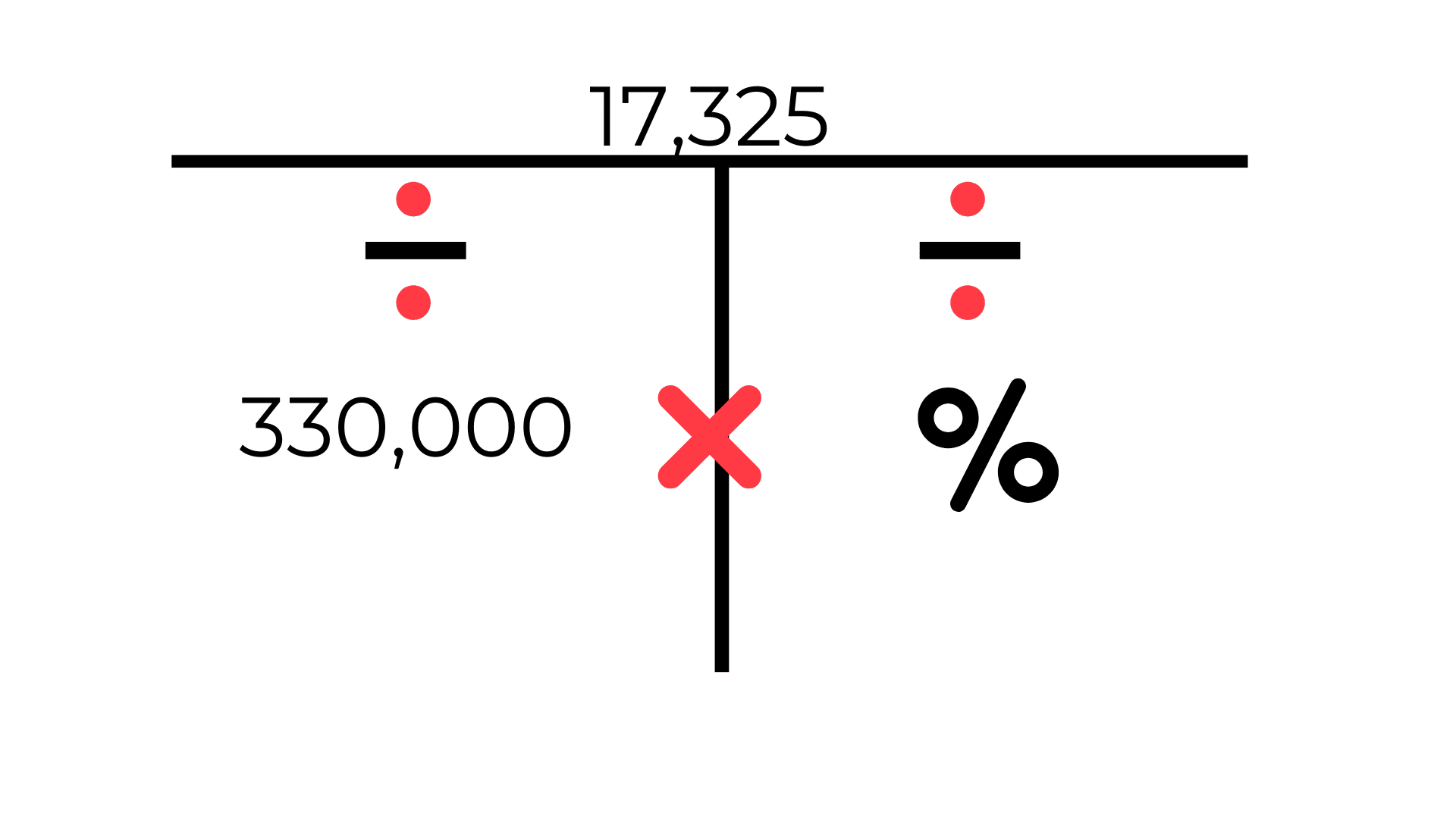

A house sells for $330,000 in Albany New York. The commission check is handed to the broker which is $17,325. What was the percentage the broker received for this transaction?

- 5.00%

- 5.25%

- 5.50%

- 5.75%

Calculate the Answer:

We are going to bring out our chart. The first thing I want you to do is break down the question. We have $330,000, which is the total, $17,325, which is a part.

That means the $330,000 goes on the left and $17,325 to the top, meaning we are solving for the percentage.

We divide 17,325 by 330,000 and get 0.0525. Then, multiply that by 100 to get a percentage, which means our answer is 5.25%.

The Correct Answer:

2

Off to the next question.

Question 2

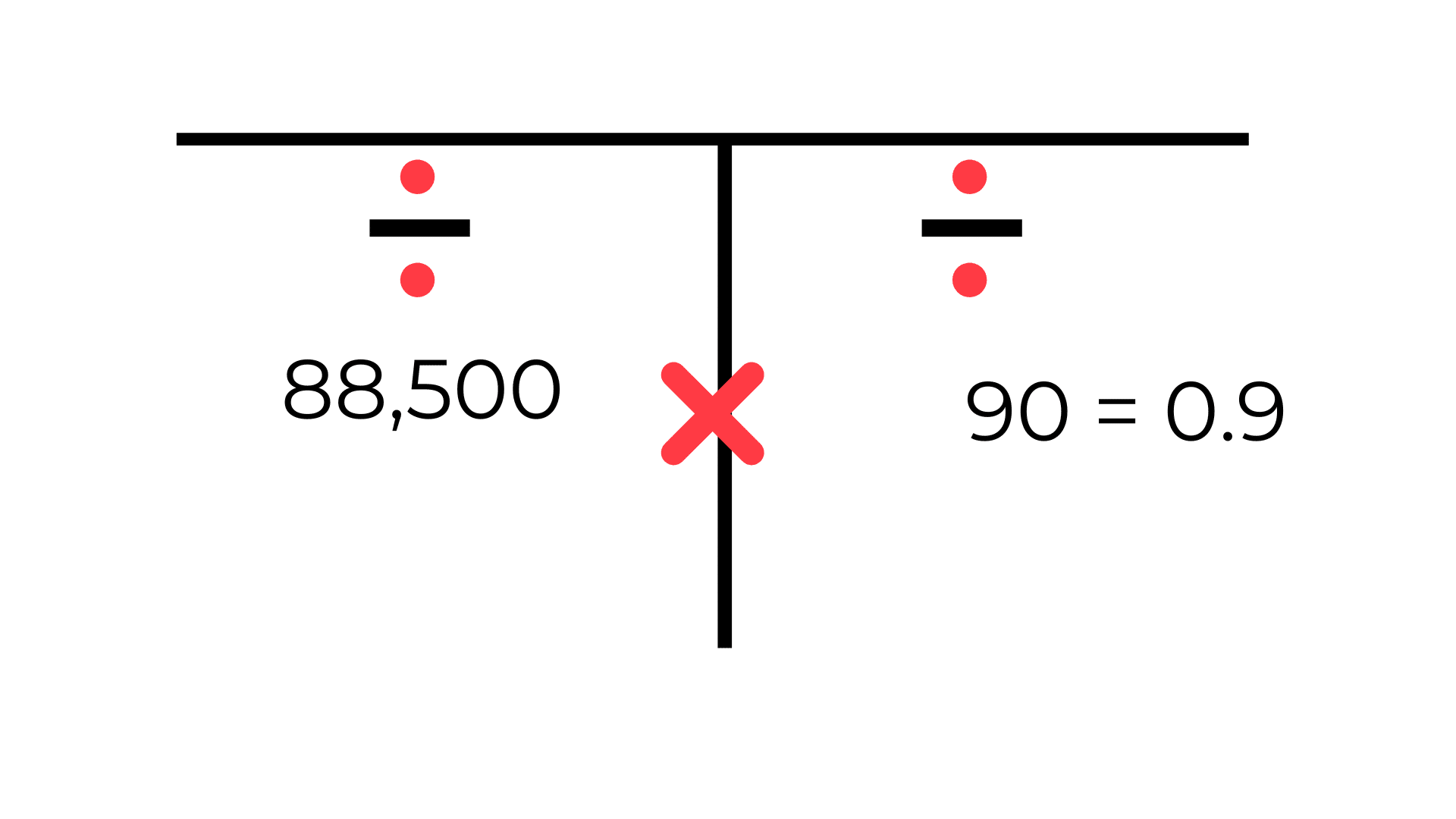

If a bank makes a 90% loan on a house valued at $88,500, how much cash is required at closing in the form of a down deposit if the buyer has already paid $4,000 in earnest money?

- $4000.00

- $8850.00

- $8450.00

- $4850.00

Calculate the Answer

$88,500 goes on the left because it is our total. Then, we move the 90% to the right because it is the rate. But we cannot work with it as a percentage, so we turn it into a decimal, which gives us 0.9

According to the chart, if you have a total and a rate, you multiply. Then we have 88,500 * 0.9 = 79,650.

We know that the bank is offering a 90% loan, meaning the bank is paying only $79,650. So, to get the total the buyer has to pay as a deposit, we subtract 79,650 from 88,500 to get 8850.

But the question states that the seller has already paid $4000. So, we subtract once more: $8850 – $4000 = $4850.

The Correct Answer

4

Question 3

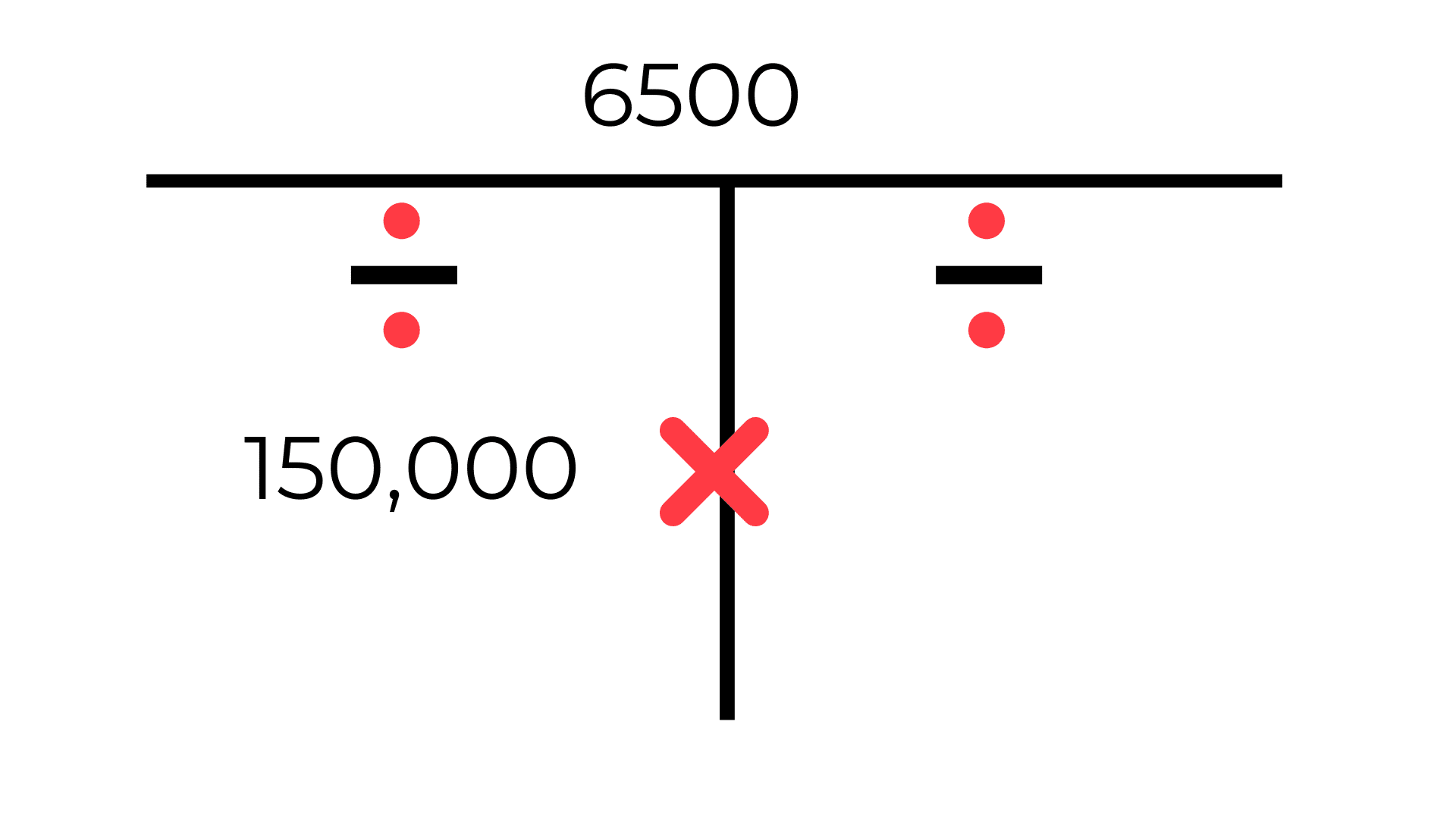

What is the interest rate on a $150,000 loan that requires an annual interest payment of $6,500?

- 3.33%

- 4.33%

- 5.33%

- 6.33%

Calculate the Answer

Interest rate means percentage. We will answer this one exactly like we did in the first question. $150,000 goes to the left, and the $6500? You guessed it, to the top.

We divide 6500 by 150,000 to get 0.043. And then we multiply by 100, and we get 4.33%

Don’t forget that we always divide the part by the total, not the total by the part.

The Correct Answer

2

Question 4

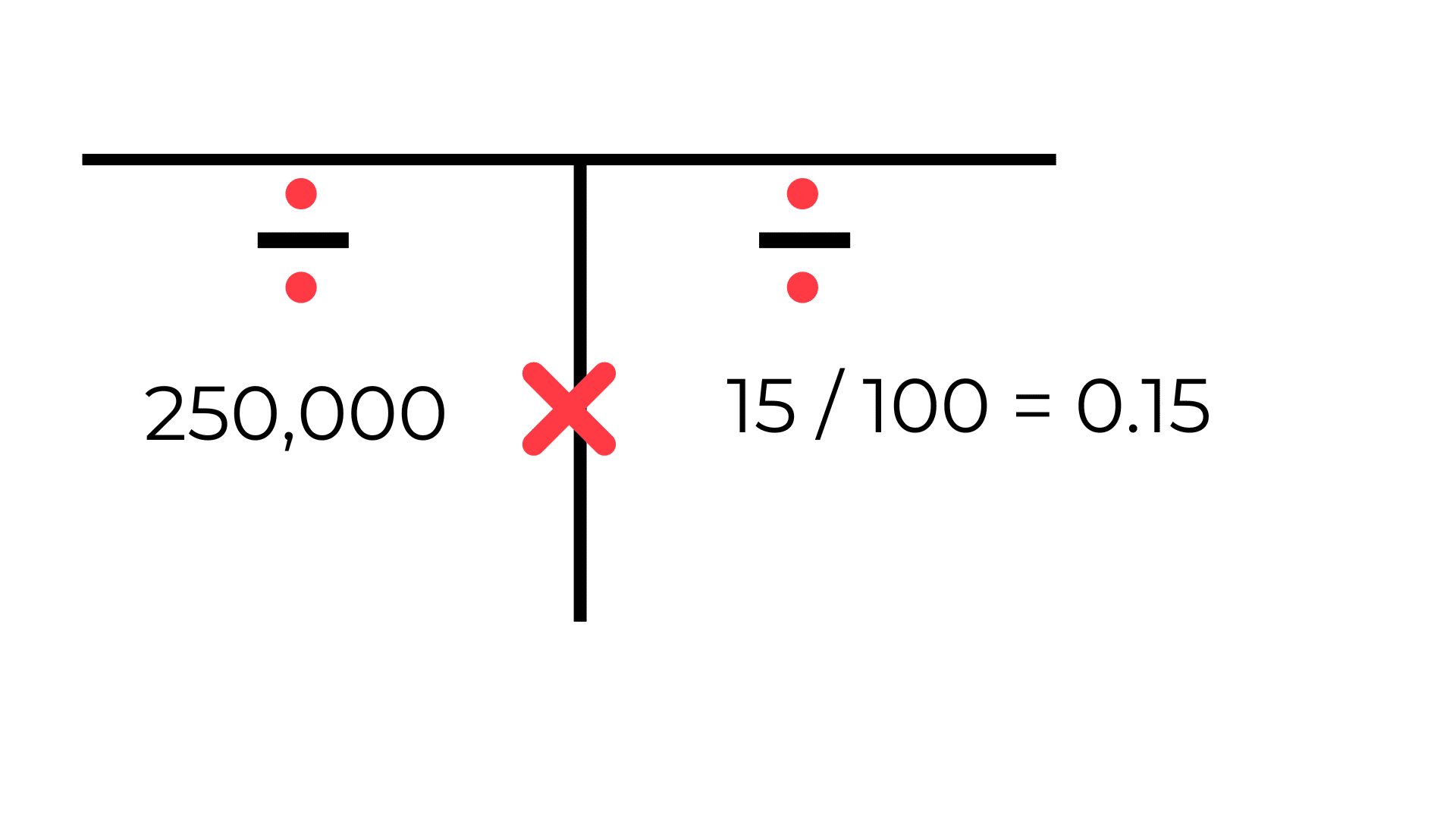

A property’s market value is $250,000. The assessment rate for the house is 15%, with 27.50 mills. Find the annual property taxes.

- $1,031.25

- $1,540.75

- $2,394.50

- $10,312.50

Calculate the Answer

Okay, so we have the total value and a percentage. We already know that we are going to multiply because it is a total and a rate.

Let’s first convert to a decimal, which equals 0.15.

0.15 * 250,000 = 37,500

But we are not yet done. The question wants us to calculate the annual property taxes, and we already know that we have 27.50 mills, and mills mean 1000, so we will divide 27.50 by 1000, which is 0.0275.

If you need a refresher on the mill rate, check out the math formula sheet on our website. I will leave a link in the description.

Multiply 37,500 by 0.0275 to give us 1031.25

The Correct Answer

1

Question 5

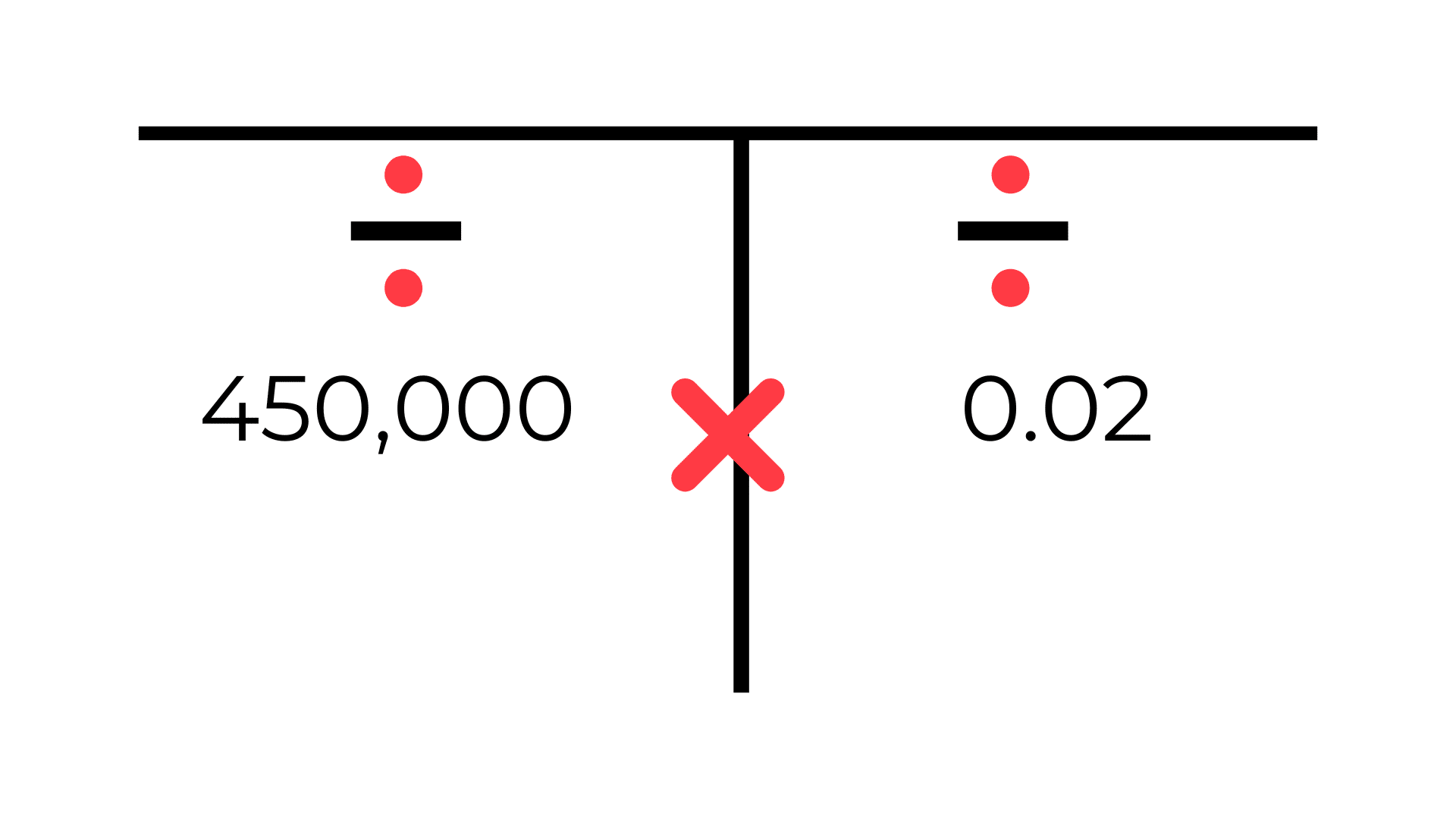

A house was sold for $450,000, which was 2% less than the original cost of the house. What was the original cost of the house? (Round to the nearest cent)

- $455,200.00

- $460,000.00

- $459,000.00

- $465,500.00

Calculate the Answer

We are still using the T-chart. 450,000 goes on to the left and the 0.02 to the right.

Can you guys guess why the 450,000 doesn’t go to the top as a part but is instead the total?

Leave your answer in the comments, I’d love to read those.

450,000 * 0.02 = 9000

So, we know that the house was sold for $9000 less than the original, which means the original price was $450,000 + $9000 = $459,000.

Correct Answer

3

Mastering Real Estate Math: Your Key to Exam Success

There is your weapon to tackle the math portion of the real estate exam. Remember, get some sleep, don’t freak out; you’ve got this.

Next Steps:

Ready to ace your real estate math? Here’s your action plan:

1. Practice the T-Chart: Draw it out and familiarize yourself with its structure.

2. Identify the variables: For each problem, determine which values are known and unknown.

3. Apply the formula: Use multiplication for total and rate, division for other combinations.

4. Double-check your work: Always verify your calculations before moving to the next question.

5. Time yourself: Practice under exam-like conditions to improve your speed and accuracy.

Did you find the T-Chart method helpful? Have you used similar techniques in your exam prep? Share your thoughts and experiences in the comments below. And if you’re looking for more exam tips, don’t forget to check out our secrets to crush exam pressure.

Remember, with the right tools and practice, you’ve got this! Keep learning, stay confident, and ace that real estate exam!