Are you ready to enter real estate but not sure if the pay is worth it? You have seen seven-figure agents flaunting their cars and mansions, and now, you are hooked.

We cannot deny the risk associated with the industry, but my students often want to know whether the reward outweighs the warning sign. What is the average hourly rate for real estate agents? According to several job boards, agents in the U.S. earn between $15.10 to $53.72 an hour.

However, it is vital to note that real estate agents don’t have an hourly rate in the normal context. They don’t get paid on an hourly basis. Their pay comes from commissions after a house sale closes.

Today, we will explore the national average across states and the factors that influence an agent’s hourly pay. Let’s cannonball into the deep end.

Average Hourly Rates

It is widely accepted that real estate agents’ earning potential is unlimited. But a not-so-popular fact is that there is a great disparity between industry perception and the earning reality of some agents.

According to the U.S. Bureau of Labor Statistics, some top-performing agents earn $57,49 per hour.

While estate agents in the lower percentile find themselves earning only $15,10 an hour. This translates to $31,410 annually.

The truth is that several factors affect an agent’s income reality. One of the top among these is location.

Where an agent is licensed has a huge bearing on their income. If you don’t believe me, read our previous article on the Worst States to Be a Real Estate Agent.

Here is a state-by-state breakdown according to Zippia.com

| Alabama: $44.92 | Alaska: $48.63 | Arizona: $38.58 | Arkansas: $40.85 | California: $47.95 |

| Colorado: $45.17 | Connecticut: $37.98 | Delaware: $45.08 | Florida: $34.37 | Georgia: $45.21 |

| Hawaii: $25.53 | Idaho: $42.73 | Illinois: $35.33 | Indiana: $40.92 | Iowa: $43.78 |

| Kansas: $36.45 | Kentucky: $41.02 | Louisiana: $31.92 | Maine: $46.21 | Maryland: $37.67 |

| Massachusetts: $53.47 | Michigan: $47.94 | Minnesota: $34.80 | Mississippi: $38.65 | Missouri:$44.73 |

| Montana: $49.26 | Nebraska: $42.75 | Nevada: $38.25 | New Hampshire: $45.48 | New Jersey: $48.08 |

| New Mexico: $41.12 | New York: $53.67 | North Carolina: $32.80 | North Dakota: $47.88 | Ohio: $40.83 |

| Oklahoma: $41.87 | Oregon: $40.64 | Pennsylvania: $45.57 | Rhode Island: $45.50 | South Carolina: $38.56 |

| South Dakota: $48.43 | Tennessee: $40.42 | Texas: $39.83 | Utah: $45.83 | Vermont: $52:94 |

| Virginia: $46.77 | Washington: $50.80 | West Virginia: $53.72 | Wisconsin: $40.48 | Wyoming: $29.78 |

Industry Trends

Over time, we’ve seen significant shifts in average hourly rates for agents. These changes often reflect broader economic and market conditions.

For instance, during periods of economic prosperity, there tends to be an uptick in property transactions. This increase can lead to higher earnings for agents due to increased commission-based income.

Conversely, during economic downturns or housing market slumps, agent income may dwindle as fewer properties change hands.

Market conditions, litigation, emerging technology, and disasters are other components that shape industry rates. Think of emerging technology. This shift toward digitalization is likely going to continue influencing how real estate professionals operate and earn moving forward.

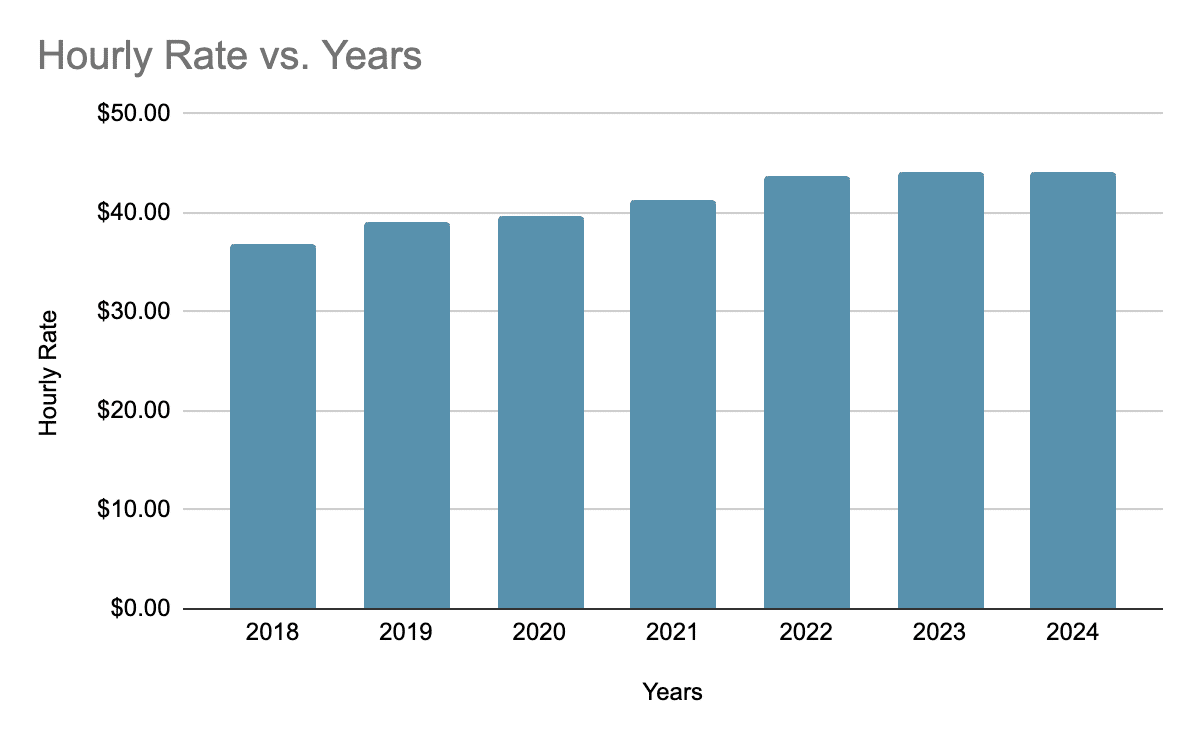

Tell me if you can see a trend in this graph, comparing the pre-COVID rates and post-COVID hourly rates:

The pre-COVID era saw a leap in agent rates. For example, in 2018, the rate stood at $36.88, but the very next year, it rose to $39.03. But in the years following the pandemic, we had $44.03 in 2023, rising to $44.13 in 2024 so far.

Did I also mention that during this time, we saw a great migration from large cities to less populated locals? This meant a pause inactivity during this season, which docked pay.

The Case for Commissions

The average hourly rate for real estate agents varies greatly depending on location, market conditions, and other factors. While the potential to earn high income is there, it’s also important to remember that a significant portion of an agent’s pay comes from commissions after closing deals.

Next Steps

If you’re considering a career in real estate, here are some steps to help you navigate your decision:

1. Research: Look into the specific rates in your state or area of interest.

2. Understand the Market: Keep abreast with current trends and changes in the property market that could affect your earnings.

3. Be Prepared: Remember that real estate is largely commission-based so be prepared for fluctuations in income.

We’d love to hear what you think about these findings! Do they align with your expectations? Have they influenced your decision about venturing into real estate? Share them in the comments below!

And if this piece was helpful, check out our article on real estate agents’ average annual earnings.

We also have a state-by-state breakdown, including highlighting how agents get paid. This article will help you understand the hourly rate per state.