As we all know, real estate laws vary from state to state. In title theory states, banks or mortgage lenders hold the title of a property until it is paid in full. In lien theory states, however, banks or mortgage lenders never retain title to the property.

What Is Title Theory?

Definition: Title theory states function where banks or mortgage lenders hold the title of a property until it is paid in full.

In title theory states, the lender holds title to the property in the name of the borrower through a Deed of Trust. When the loan is paid in full, the lender issues and records a Deed of Reconveyance, which clears the title of the property.

In title theory states the mortgage should contain a defeasance clause.

What Is Lien Theory?

Definition: In lien theory states banks or mortgage lenders never retain title to the property. Instead, the mortgage lender holds a lien against the property.

In these states, the deed stays with the borrower, and the lender places a lien on the property using a mortgage. The lien ends when the loan is paid in full.

What is Intermediary Theory?

Definition: Intermediary theory states function where the borrower retains the title however, the lender can take back the title if the borrower defaults on the loan (without judicial proceedings).

Title Theory vs Lien Theory

In addition to how the title is held, there are differences in the way foreclosures are handled.

Generally, foreclosure in title theory states occurs through non-judicial proceedings (handled by a trustee), while lien theory states are conducted via judicial methods (typically a lawsuit).

In conclusion, each theory has special considerations on who holds the title, and how foreclosure proceedings take place is the distinction between the two.

Does My State Have Title Theory, Lien Theory, or Intermediary Theory?

Want to know where your state lies? Don’t worry; we put together a full list for you. Take a look down below. Or keep scrolling to check out our printable map.

Title Theory States:

- Alaska

- Arizona

- California

- Colorado

- Washington D.C.

- Georgia

- Idaho

- Mississippi

- Missouri

- Nebraska

- Nevada

- North Carolina

- Oregon

- South Dakota

- Tennessee

- Texas

- Virginia

- Washington State

- West Virginia

- Wyoming

Lien Theory States:

- Arkansas

- Connecticut

- Delaware

- Florida

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- New Mexico

- New York

- North Dakota

- Ohio

- New Jersey

- Pennsylvania

- Puerto Rico

- South Carolina

- Utah

- Wisconsin

Intermediary Theory States:

- Alabama

- Hawaii

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Montana

- New Hampshire

- Oklahoma

- Rhode Island

- Vermont

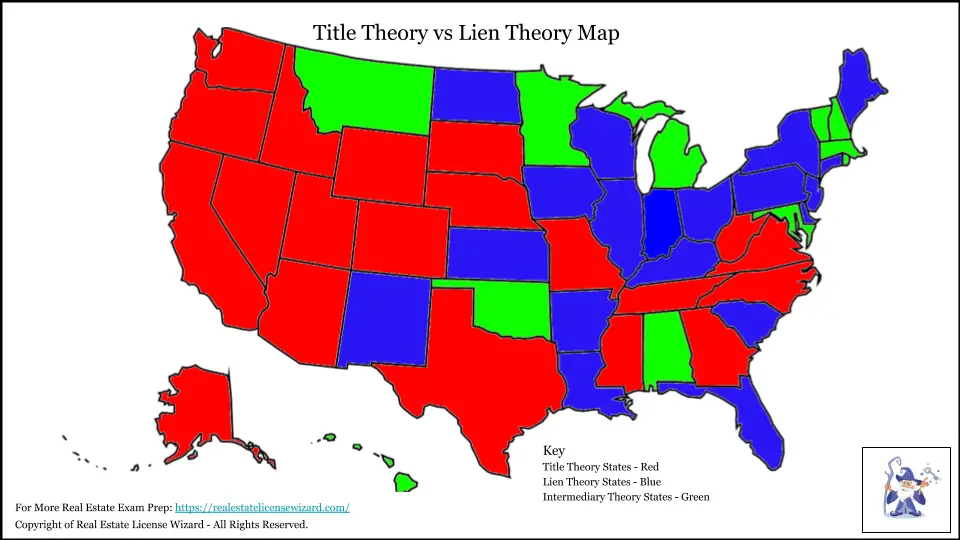

Title Theory vs Lien Theory Map

For a full downloadable version of the map, check it out here: Title Theory vs Lien Theory Map

The State of Utah Supreme court has twice affirmed that Utah is a Lien Theory state. Foreclosures are handled by a trustee for the lender, and the purchaser (buyer/homeowner) holds legal title to the property. When the property is foreclosed any equity in the property goes to the homeowner (person not the lender). In addition, The Utah Homestead Act protects the equity in the property for the homeowner for one year in the amount of $42,000 for one owner and $86,000 for two (spouse not children. If you have questions, you may contact me at the address below or call the school at 801-269-8889

Updated! Thank you.